Christmas is a time for giving, and whilst home ownership seems like a gift only possible for billionaires to give, it is actually more accessible than some people may believe.

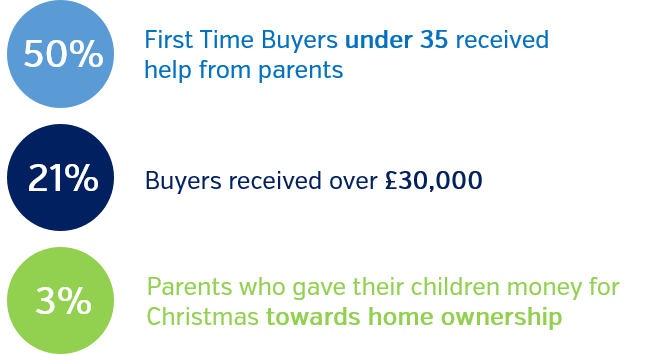

You might think gifting a house is wildly impossible for the average gift giver, and you’re not completely wrong. If someone is a homeowner already, even buying jointly with someone, will hike up stamp duty as a second home. There are other less expensive alternatives though, research in 2020 suggested that over 50% of first time buyers under the age of 35 received help from their parents, as well as a significant amount of people aged over 35. There are various other routes that can help parents or loved ones give the ultimate gift.

If a joint mortgage still seems like the best route, one alternative is a joint policy sole proprietorship mortgage, where Mum and Dad go on the mortgage, but not the property deed. Although, this does also mean joint responsibility for mortgage payments and a substantial long term financial commitment. A similar, less expensive option is to act as a guarantor, there is no initial outlay, rather the gift giver pledges to pay the mortgage if the buyer is unable to. Most lenders require the guarantors to be aged under 75, but depending on those involved, this could be a gift given for free!

On the other hand, family members or friends can help out with the initial deposit without a long term commitment, by simply gifting money for the deposit pot. Gifts do have some of their own complications though. Inheritance tax can kick in if the gift-giver dies within seven years of the money being given, and in the majority of cases, mortgage lenders want a letter or form that confirms where the gift is coming from and that it is not expected to be paid back. This is both to protect the buyer from any attempts in future to reclaim the money, and to confirm it is not a loan, which would impact affordability. Some protections can be stipulated for the gift giver; if parents give towards a child and their partners deposit, and if that relationship was to end, they can specify that the money was given only to their child.

Such an expensive gift might be unrealistic for family members that are planning for their own futures, but there are still other options. A family springboard mortgage is an option where family members or friends can eventually get their money back. The gift-giver agrees to put money into a mortgage-linked account, and gets it back after a certain number of mortgage payments. This benefits the gift giver in not having to commit to mortgage payments, but also ensures the money is eventually returned, generally even with added interest. Equity release might be a method by which parents get the money to help their children, or some family mortgages don’t require the hassle, allowing a first time buyer to get a mortgage secured against their parent’s home.

It is certainly not only billionaires who can give the gift of a home at Christmas, with various options to work for people depending on circumstances. If you would like to explore these options, it is best to get professional legal or financial advice.

Contact our advisors at RSC New Homes or Mortgages First for expert financial guidance.

Call RSC New Homes today on 0161 486 6278

Call Mortgages First today on 01206 731800

*Sources:

Money Supermarket – All you need to know about gifted deposits

HomeOwners Alliance – Gifted Deposits Explained

The Telegraph – How to help your children buy a house in the UK without giving away cash

Legal & General – Bank of Mum and Dad funds one in two house purchases among under-35s Legal & General research reveals

Zoopla – Revealed: how much parents give their children to help them buy a home

Our experienced land & new homes experts can provide you with the knowledge & expertise that you need.