The average age of a first time buyer in the UK is around 33, and whilst that age has increased in the last few decades, it is still, we can agree, young. Yet the reality is, plenty of people who dream of home ownership are a lot older than 33, and many of them don’t fit into the category of a first time buyer. Wrestling with affordability is much more widespread. Home ownership is a goal across society, and one people could so with some help achieving. Luckily, there is a scheme under our noses that is too often overlooked. And what is this scheme …?

Too many people assume that shared ownership is a scheme aimed only at first time buyers, but it can help far more people than that. There are of course criteria to be eligible, but nothing specifically about being a first time buyer. Instead, the key conditions are:

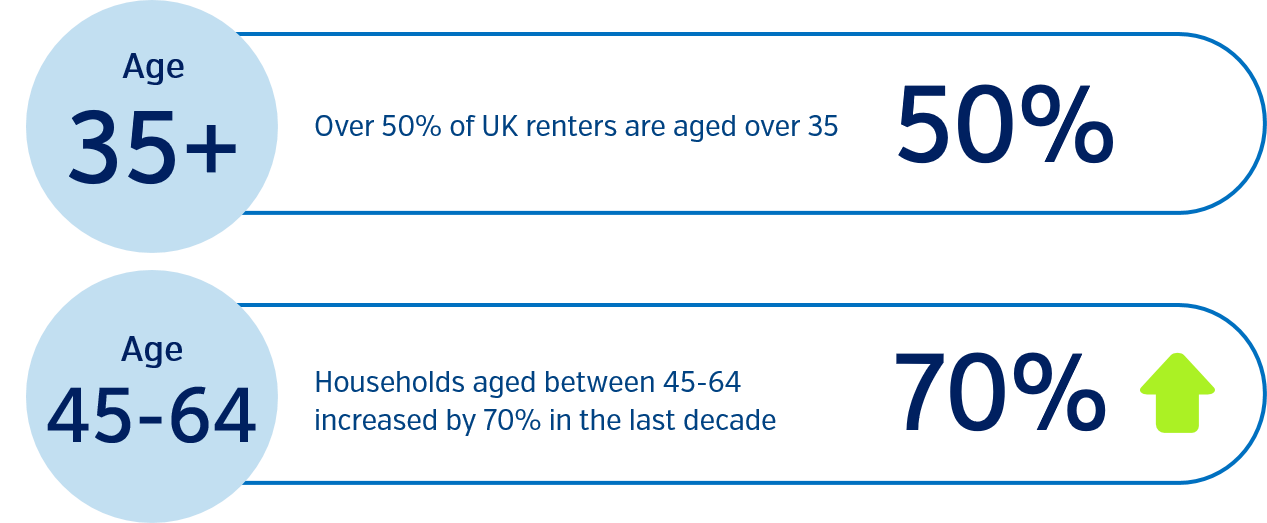

When we consider people who don’t own their own homes, there are many types of circumstances they could be in. In 2022, research found that over half of UK renters are aged over 35, with the number of households aged between 45 and 64 having increased by 70% in the last decade.

Half this age bracket would like to buy their own home, but in many cases, circumstances are pricing them out. Perhaps a relationship breakdown has seen someone’s income and savings cut in half, whilst simultaneously seeing one family home turned into two, or a single parent has been working and saving for years, but can’t afford a home big enough for their and their children’s needs. These are just two examples of cases where Shared Ownership could be the assistance needed, allowing a smaller deposit to go further; helping people to overcome difficult circumstances and achieve home ownership.

Another case could be where the home someone can afford is not right for their specific needs. In this case there’s a specific scheme, Home Ownership for people with Long-Term Disabilities (HOLD), where the goal is a home that fulfils accessibility needs. The scheme is subject to specific disability conditions, but overall, aims to help a section of society where less than 50% achieve home ownership.

With a smaller mortgage the financial hurdles are easier to jump, and in these cases, moving from the rented sector to a shared ownership home, could be a lot more affordable in the long term. A shared ownership home, if not brand new, will be only a few years old, with all the energy efficiency savings that comes with that. The rents paid on the unowned share of the home, are generally less than on the open market – 2.75% of the value per annum, and increases are restricted in a way that private rents are not. In a recent survey it was found that 56% of over 55s who have bought through shared ownership did so because of affordability.

There is in fact a specific scheme for over 55s, Older Persons Shared Ownership (OPSO), is designed to help people ‘rightsize’. The idea being that there are thousands of older people who own their home and have some equity, but don’t have enough to be able to buy a more manageable or accessible home outright. In these cases, shared ownership is the alternative when finding the right mortgage is impossible, older people can sell a home that has become too large or inaccessible, transferring the equity they have to a share of something more suitable. The key difference is that the maximum share is 75% with no rent payable on the remaining, helping ensure the home will remain open to shared ownership schemes, whilst some OPSO schemes work alongside Extra Care facilities, to make assisted living more accessible.

Our experts at The SO Hub can help get you up to speed on shared ownership, the schemes available for your customers and help you make the right choices for your development needs. Get in touch to find out how we can expand the target market for you.

*Sources

Help to Buy Agent – HOLD – Home Ownership for people with Long-Term Disabilities

Housing 21 – APPG on Housing and Care for Older People

Money – First-time buyer statistics and facts: 2022

Office for National Statistics – Disability and housing, UK: 2019

Paragon – Middle-aged renters surge

Share to Buy – Shared Ownership Eligibility

Share to Buy – Older Person Shared Ownership

Share to Buy – What is Shared Ownership

Our experienced land & new homes experts can provide you with the knowledge & expertise that you need.